A Case Study of Unintelligent Speculation

Svolder’s A-share (ticker: SVOL A) today closed at SEK 243.50, down from an intra-day high of SEK 275.00. During the last twelve months the A-share reached a low of SEK 112.50 and a high of SEK 275 (Source: Avanza).

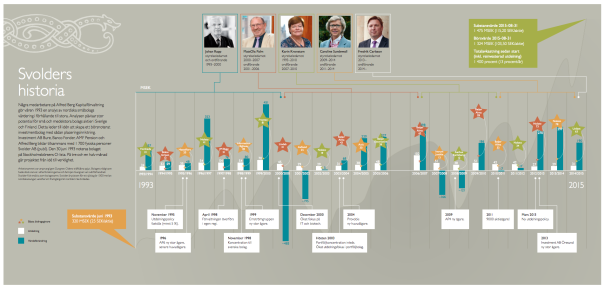

Svolder is a Swedish investment company founded in 1993 and listed on the Nasdaq OMX Nordic exchange. Svolder invests in small and mid cap listed entities. Click image below for a brief history in Swedish of Svolder (Source: Svolder).

Net Asset Value per Share as of May 31, 2016

The equites portfolio as of May 31, 2016 is shown below. As of this date, the market value of the equities portfolio amounted to SEK 1,644.1 billion. Adjusting for net debt/net receivable results in a total net worth of SEK 1,859.6 billion, equal to a net asset value (NAV) of SEK 144.60 per share (Source: Svolder).

Svolder’s equities portfolio as reported in the most recent quarterly report per May 31, 2016 was made up of the following equities (Source: Svolder).

Net Asset Value per Share as of August 12, 2016

Per August 12, 2016, Svolder reported a NAV of SEK 162 per share (Source: Svolder). The current share of SEK 243.50 is about 150.3% of NAV. At SEK 275 it’s 169.8%. A reasonable expectation would be that the share price would stay close to NAV.

One may wonder why on earth someone would be willing to pay a lot more than NAV for the A-share for a collection of marketable common stocks that Svolder currently owns? Sure, you get 10 votes for each A-share compared to 1 vote per B-share. But that looks like a very optimistic view in regards to the value of the votes connected to each A-share.

Shares Outstanding

Svolder’s shares outstanding disclosed in the 2015 annual report per December 31, 2015 was 12,800,000, consisting of 622,836 A-shares (10 votes per share) and 12,177,164 B-shares. Below an excerpt from the 2015 annual report (in Swedish).

Final Words

To wrap this up. Right now the Svolder A-share is trading at a price-level that is not supported by underlying value. I’m on the sidelines here, but when I saw this case earlier today I was just fascinated of what I was just looking at. One last question: How long will it take for the A-share to trade in line with underlying NAV? Guess we’ll have to wait and see.

For some final words, here’s an excerpt from The Intelligent Investor.

Outright speculation is neither illegal, immoral, nor (for most people) fattening to the pocketbook. More than that, some speculation is necessary and unavoidable, for in many common-stock situations there are substantial possibilities of both profit and loss, and the risks therein must be assumed by someone. There is intelligent speculation as there is intelligent investing. But there are many ways in which speculation may be unintelligent. Of these the foremost are: (1) speculating when you think you are investing; (2) speculating seriously instead of as a pastime, when you lack proper knowledge and skill for it; and (3) risking more money in speculation than you can afford to lose.

Disclosure: I have no position in the stock mentioned, and no plans to initiate any position within the next 24 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. This article is informational and is in my own personal opinion, and should not be considered investment advice. Always do your own due diligence and contact a financial professional before executing any trades or investments.